As the end of 2020 quickly approaches and we pause in gratitude amidst the hustle and bustle, please consider the lasting impact you can give to your community this holiday season by making a donation to River Valley United Way.

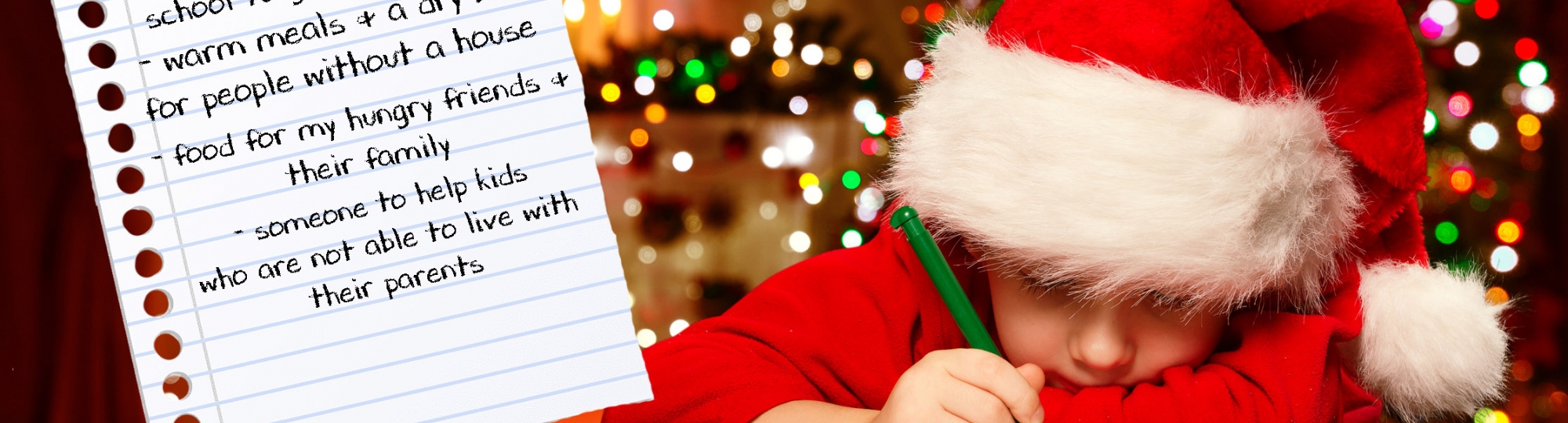

Feeling grateful for a warm home, health insurance, or food for your holiday merriment? Glad you can pay all your bills and still have something left over at the end of the month? Then, perhaps you’ll want to consider a generous year-end gift, a gift that will create a lasting impact well into 2021 for our friends and neighbors seeking a chance to thrive. You can reach beyond the holidays into next year by giving generously to help create a better future.

Turn your holiday into something larger this year by helping create a future that works well for everyone. Light up a life with your generosity – and light up your own in the process!

There are many ways to give:

If you would like your gift to be recorded in the calendar year 2020, please keep the following information in mind:

New Online credit card gifts

New gifts should be made on United Way’s website or your workplace campaign site no later than 11:59 pm on December 31st. GIVE NOW

Pledge Payments by Credit Card

Donors may call 479-968-5089 and leave your name and callback number by noon on December 31st. A Customer Service team member will return your call to obtain your credit card and gift information.

Personal or Business Check

Checks must be postmarked and dated no later than December 31st. Mail checks to River Valley United Way, Attn: 2020 Giving, PO Box 636, Russellville, AR 72811

Stock Gift

Stock must be transferred and received in the River Valley United Way stock account no later than the end of market day on December 31st. For more information, please call 479-968-5089 and a Major Gifts team member will return your call. Please initiate your stock transaction 10-14 days before year-end to ensure it is received by the last business day of the year.

Electronic Fund Transfer

Funds must be transferred and received in the River Valley United Way bank account no later than the end of business day on December 31st. For more information, please call 479-968-5089 and a Customer Service team member will return your call.

Reduce income tax on Your 2020 Roth IRA conversion

You can make a charitable contribution through your Roth IRA or traditional IRA to River Valley United Way and help move the community from COVID Relief to Recovery and Rebuilding.

If you’re 70.5 or older, there may be some added tax benefits when making your “Qualified Charitable Distribution” (QDC) from your IRA. This could be a smart choice for you this year. At age 70.5 or older, donating funds from your account directly to United Way of Monroe County does not count as income, thus fulfilling your required minimum distribution while bypassing your gross income. In many cases, that surpasses the benefits of making a standard charitable contribution.

Other potential advantages:

- Your gift allows you to support United Way’s expanded work for COVID Relief and Recovery and is put to immediate use.

- Your gift minimizes your tax obligation at the federal and state level.

- Your gift may keep you in a lower tax bracket.

Contact your financial adviser today and request that a “Qualified Charitable Distribution” be made directly to River Valley United Way. Here’s what you’ll need to do to make this smart donor choice:

- Ask your financial advisor to include this information in your correspondence to United Way: include your name, address, and intention to use your gift as a 2020 IRA Qualified Charitable Distribution as a charitable gift to United Way.

- Your gift should be made out to River Valley United Way and sent to PO Box 636, Russellville, AR 72811

- Provide River Valley United Way’s Tax ID (EIN number) to your financial advisor: 71-0410894

While many IRAs are eligible for QCDs—Traditional, Rollover, Inherited, SEP (inactive plans only), and SIMPLE (inactive plans only)—there are requirements. To determine if your IRA qualifies for a gift to River Valley United Way and for additional guidance, please consult your tax advisor or financial consultant.

For IRS Resources, click here.